How to Determine Which 1040 Form to Use

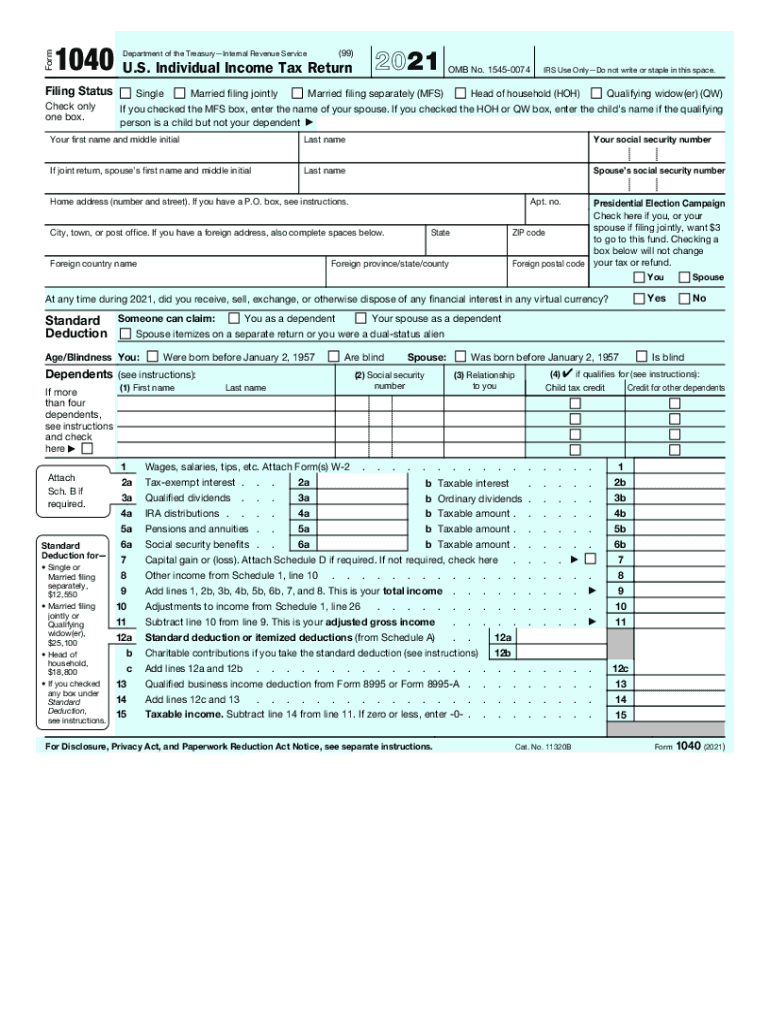

They are intended for people who have uncomplicated tax returns. For tax year 2021 taxpayers impacted by COVID19 can elect to use either the 2019 or 2021 earned income to figure the 2021 earned income tax credit.

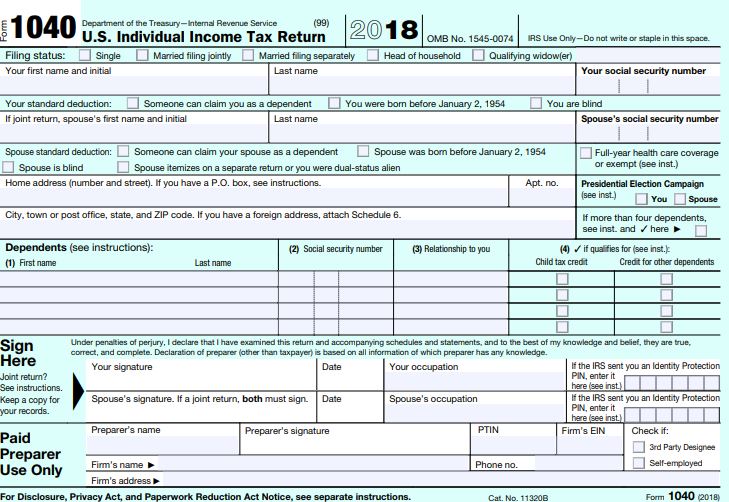

Form 1040 U S Individual Tax Return Definition

You can file the 1040EZ return if.

. Here are a few general guidelines on which form to use. Previously filers with simple tax situations could use the 1040EZ or 1040A. You will need your 2019 return with your earned income listed to complete this within the program.

What tax form is used for qualified dividends. 1040EZ Single or Married Filing Joint Under age 65 No dependents. You can always use Form 1040 regardless of whether you qualify to use Form 1040A or 1040EZ.

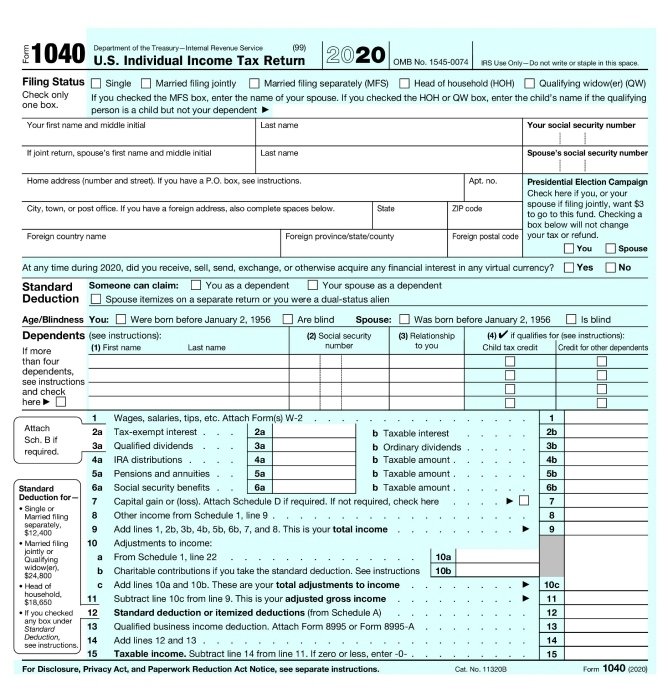

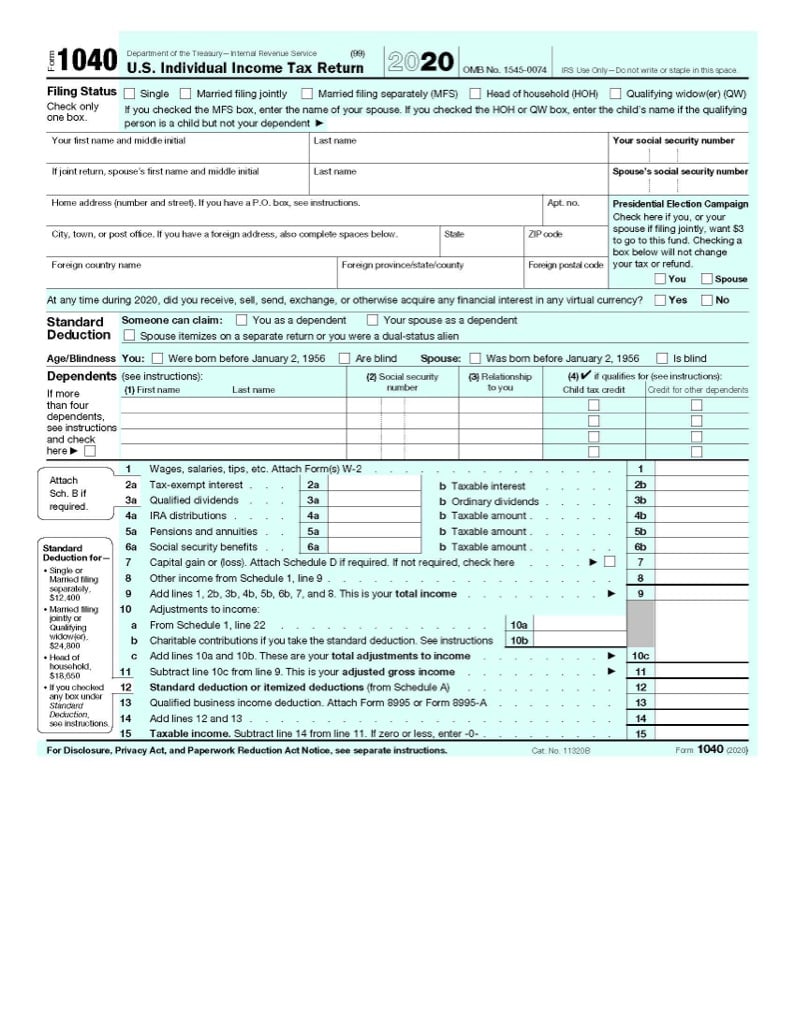

Simplest IRS form is the Form 1040EZ. For the tax year 2020 check the line 8b on the form 1040. Calculate your qualified dividend amount using Form 1099-DIV.

This form has various versions. For the tax year 2020 check the line 8b on form 1040-SR. Fill-in your personal information.

Federal income tax withheld. And ever since the IRS doubled the earning limit on filers who use it the EZ has been available to even more taxpayers. If you are 65 year old or older you have the option to use Form 1040-SR instead of the usual Form 1040.

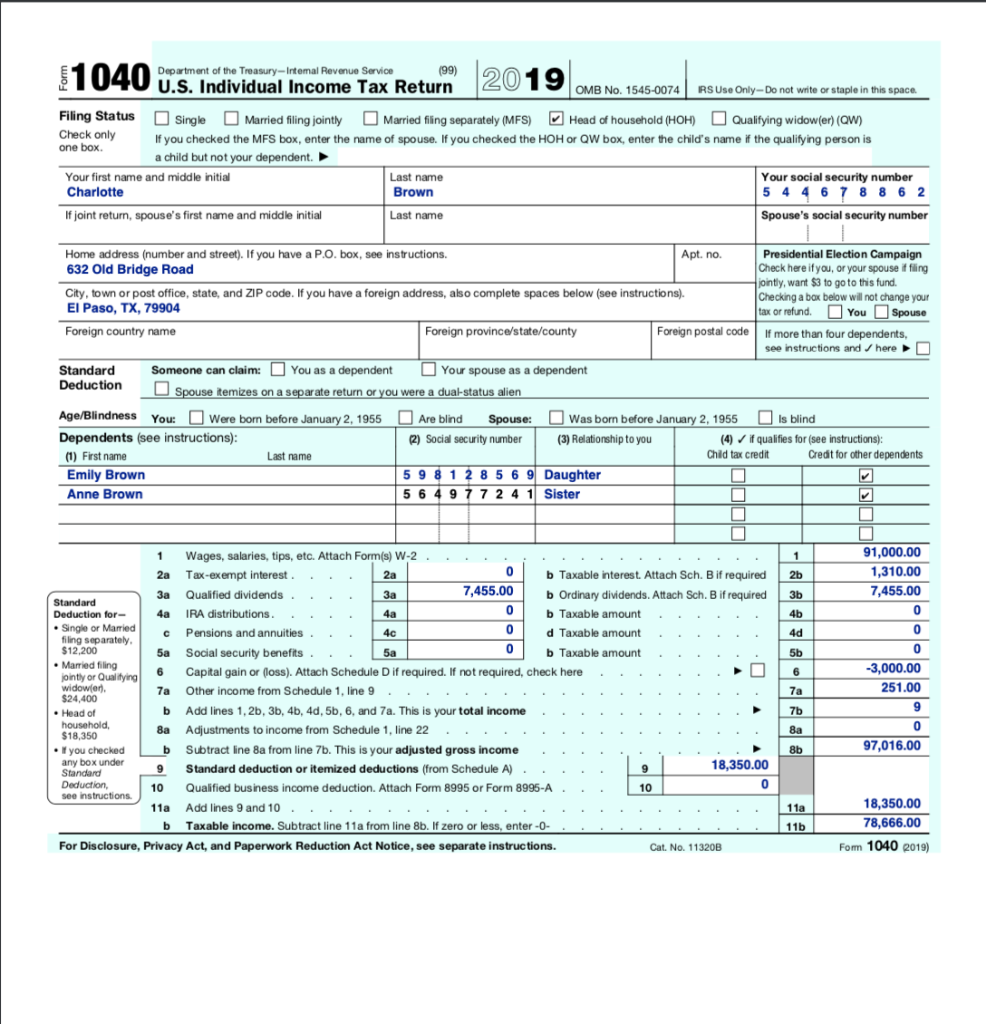

Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. Add this number to Form 1040 Line 1 from earlier. The taxpayer does not have to file Schedule D and heshe reported capital gain distributions on Form 1040 line 7.

The only exception to this is Form 1040NR which nonresident aliens use. File Your Taxes Today. The taxpayer reported qualified dividends on Form 1040 Line 3a.

This number can be used on your FAFSA depending on how your application was filled out. Forms 1040A and 1040EZ are just simplified shorter versions of Form 1040. Filing your taxes just became easier.

Youll be able to access your most recent 3 tax returns each of which include your Form 1040the main tax formand any supporting forms used that year when sign into 1040. File your taxes stress-free online with TaxAct. If you were self-employed even for just some of the year find Schedule 1.

The simplest IRS form is the Form 1040EZ. TurboTax Makes It Easy To Get Your Taxes Done Right. If youve never done it before you cant help but learn something in the process.

Ordinary dividends should be filed in Box 1a qualifying dividends should be filed in Box 1b and total capital gain distributions should be filed in Box 2a. If you do not have your 2019 return you can request a transcript of the return on the IRS website. Individual Income Tax Return Form 1040-SR US.

Nonresident Alien Income Tax Return enter the ordinary dividends from box 1a of Form 1099-DIV Dividends and Distributions. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Information You May Need.

As of 2019 there is only one version of the Form 1040 which means all tax filers must use it. Then follow the directions below. One of our filers.

Both forms are nearly identical except that Form 1040-SR has larger font and it has more information about. Using Your W-2 to File Your 1040EZ. For your earned income subtract Line 14 of Schedule 1 under Adjustments from Line 3 of Schedule 1.

This interview will help you determine which form you should use to file your taxes. Tax Return for Seniors or Form 1040-NR US. Who should use Form 1040-SR.

Thats your 2019 earned income. MAGI is not included on your tax return but you can use the information on your 1040 to calculate it. Your age your spouses age and filing status.

Here I take a look at preparing a Form 1040. If the amount on line 33 is larger than the amount on line 24 thats what you overpaid. You can determine the value of your adjusted gross income from different lines on various forms.

In the United States form 1040 is used for federal income tax returns. If you file electronically the tax preparation software will determine which form you should use. On line 3a of Form 1040 Form 1040-SR or Form 1040-NR enter any qualifying dividends from box 1b on Form 1099-DIV.

Filing jointly through the FAFSA implies that your parents income was reported from one joint tax form. Ad Prepare Print and E-File Your 1040 Tax Form Free. Per the IRS Form 1040 Instructions this worksheet must be used if.

When you file your 2021 taxes which you file in early 2022 you will most likely use the standard version of Form 1040. Enter this overpayment on line 34. And finally the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

If you are NOT a dependent enter 12400 If you ARE a dependent and line 1 is 12400 enter 12400 If you ARE a dependent and line 1 is. No Tax Knowledge Needed. To see this select Forms View then the DTaxWrk folder then the Qualified Div Cap Gain Wrk tab.

Click on any of the images to enlarge The top of the form simply asks for some basic information such as your name SSN address etc. In theory you should get this amount back as a refund. Subtract line 24 from line 33.

However these forms are no longer in use because of the tax plan that President Trump signed into law in late 2017. Ad TurboTax Free Edition For Simple Tax Returns Only. To access your 1040 online check with the e-filing provider you used for the year in question eg your 2020 tax return that you filed in 2021.

The advantages of Form 1040A or 1040EZ is they are easy to fill out and easy to read. The 1040A covers several additional items not addressed by the EZ. Youll need to find your adjusted gross income line 8b and add several deductions back to it including deductions for IRAs student loan interest and tuition certain types of income losses and more.

On line 3b of Form 1040 US. Your tax return amount is in general based on line 24 total tax owed and line 33 total tax paid. In this simulation you will take on the role of Cicely King in order to learn how to use the information from.

How Do I Calculate My Tax Return. This tax form many times a 1040 tax form combines both parents income and reports their adjusted gross income in one amount.

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Printable Irs Form 1040 For Tax Year 2020 Cpa Practice Advisor

Form 1040 Irs Form 1040 Instructions Free Template

Form 1040 1040 Sr Everything You Need To Know

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

The New 1040 Form For 2018 H R Block

2021 Form Irs 1040 Fill Online Printable Fillable Blank Pdffiller

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Solved 11040 Department Of The Treasury Intemal Revenue Chegg Com

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

1040 Simplified Drake18 A New Form 1040 Will Be Used Starting With Tax Year 2018 As Part Of A Larger Effort To Help Taxpayers The Internal Revenue Service Plans To Streamline The Form 1040 Into A Shorter Simpler Form For The 2019 Tax Season Tax Year

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

How To Fill Out Your Form 1040 2020 Smartasset

1040 Simplified Drake18 A New Form 1040 Will Be Used Starting With Tax Year 2018 As Part Of A Larger Effort To Help Taxpayers The Internal Revenue Service Plans To Streamline The Form 1040 Into A Shorter Simpler Form For The 2019 Tax Season Tax Year

What Was Your Income Tax For 2019 Federal Student Aid

2021 1040 Form And Instructions Long Form

Printable Irs Form 1040 For Tax Year 2020 Cpa Practice Advisor

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Comments

Post a Comment